“The world’s carbon budget is finite and running out fast; we need a rapid transition to net zero.” These are not the words of the leader of an environmental group or a green party. They are the words of the CEO of BP, one of the largest oil companies in the world, launching BP’s new strategy in September 2020.

He went on to say: “We have got to change – and change profoundly. But it is more than having to change – we want to change, because it is the right thing for the world, and it is a tremendous business opportunity for BP.”

BP’s new strategy includes increasing its renewable energy portfolio from 2.5GW last year to 50GW by 2030, when its annual investment in low-carbon energy will reach $5billion. More importantly, it aims to reduce oil and gas production by 40%.

So is this real or green-washing? Is BP alone or are the other oil majors on board as well?

Historically, all the words and promises have not been backed up with hard dollars. The following graph produced by S&P Global Market Intelligence shows the percentage of total investment that the oil majors have devoted to emissions reduction. Excluding Total SA of France, the average is close to 1%.

But perhaps BP’s new commitment signals the start of something more promising? I decided to take a snapshot of the oil majors’ websites to see whether I could glean a turning of the tide. Here is what I found as at the time of writing.

Starting with BP, the feature project on their home page is an Omani natural gas field. Two prominent posts are titled ‘Reimagining Energy’ and ‘Net zero by 2050’. Under ‘Who we are’, I find: Our purpose is reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives.

At Shell, they describe themselves as an international energy company that aims to meet the world’s growing need for more and cleaner energy solutions in ways that are economically, environmentally and socially responsible. The feature story on their home page is an interview with the CEO titled ‘Can Shell transform? Yes. And we will.’ Its transformative strategy seems aligned with BP’s but with a greater emphasis on hydrogen technology.

ExxonMobil’s top feature stories cover a new oil development in Guyana, a technical evaluation of extracting CO2 from the air, purchasing renewable diesel, and its COVID-19 response. Their headline statement is: The need for energy is universal. That’s why ExxonMobil scientists and engineers are pioneering new research and pursuing new technologies to reduce emissions while creating more efficient fuels. We’re committed to responsibly meeting the world’s energy needs.

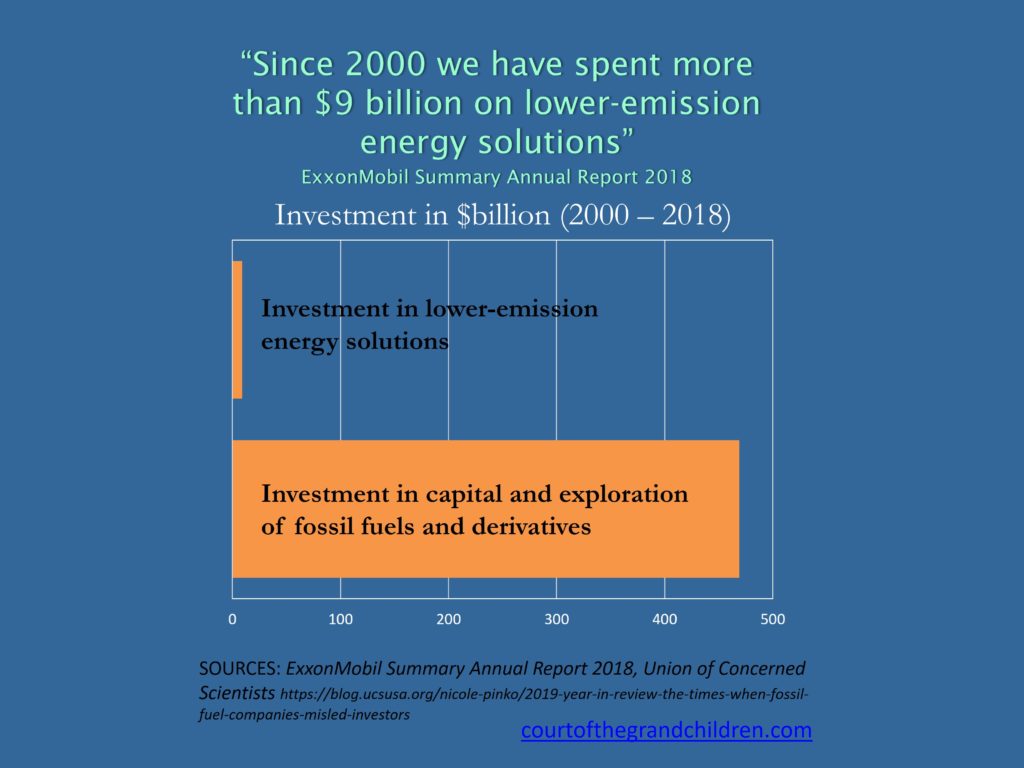

Exxon’s statement has a lot of words about research and new technology. They even quote numbers in the billions of dollars invested in renewables. But Exxon is a big company and this graphic illustrates the reality behind the green-wash.

The headline stories on Chevron’s website are the buyout of Noble Energy which brings more fracking and Mediterranean assets, turning plastics into new materials, and its COVID response. Chevron uses the tagline ‘the human energy company’. When I searched with the keyword ‘emissions’ I found this statement in the fourth layer of their site hierarchy: Chevron supports the Paris Agreement and views it as an important step toward global engagement and cooperation to address climate change. The initiatives it cites are all related to its direct emissions without reference to the products they sell.

On its homepage, Total SA promotes its September investor day presentations, expansion in the Spanish solar market, a JV to manufacture automotive batteries in Europe, and Total’s May 2020 announcement to target net zero emissions by 2050 including from the products it sells in Europe.

When you arrive at ConocoPhilips home page you are met with the following words in large letters: We explore for, develop and produce crude oil and natural gas globally. One thing for sure, there is not even a vague attempt at green-washing on their website.

The most striking conclusion from this cursory survey is that the European companies (BP, Shell, Total) are far more advanced and committed to change than their American peers. The same conclusion can be drawn from the first graphic discussed previously. This is probably due to pressure from European investors and legislators. Money talks, and so there is hope that as American and global investors shift away from fossil fuels, the large American companies will follow their European counterparts.

I do hope that it all happens quickly enough. We can do our part by insisting that our pension and superannuation funds are not invested in fossil fuel companies that are not undergoing the transformation required to meet the Paris Agreement.